Malaysia’s Budget 2025 aims to reinvigorate the economy through various tax reforms and tax measures impacting both businesses and individuals.

Unveiled by Prime Minister Datuk Seri Anwar Ibrahim on 18 October 2024, Malaysia Budget 2025 represents a crucial turning point for the nation’s economy with a record allocation of RM421 billion.

The theme, ‘Membugar Ekonomi, Menjana Perubahan, Mensejahtera Rakyat’ (Reinvigorating the Economy, Driving Reforms, and Prospering the People), reflects a dual focus in addressing immediate socio-economic challenges and building long-term resilience.

This budget balances economic growth, fiscal prudence and social welfare. It aims to revitalise the economy through key tax reforms and tax measures, addressing post-pandemic recovery, technological advancements, and climate change while improving the welfare of the Rakyat.

Our exclusive Malaysia Budget 2025 Commentary delves into the intricacies of these tax measures, providing valuable insights that will impact both the business and individual landscapes.

✓ Business Tax Reforms and Incentives for Corporate Taxpayers and Businesses

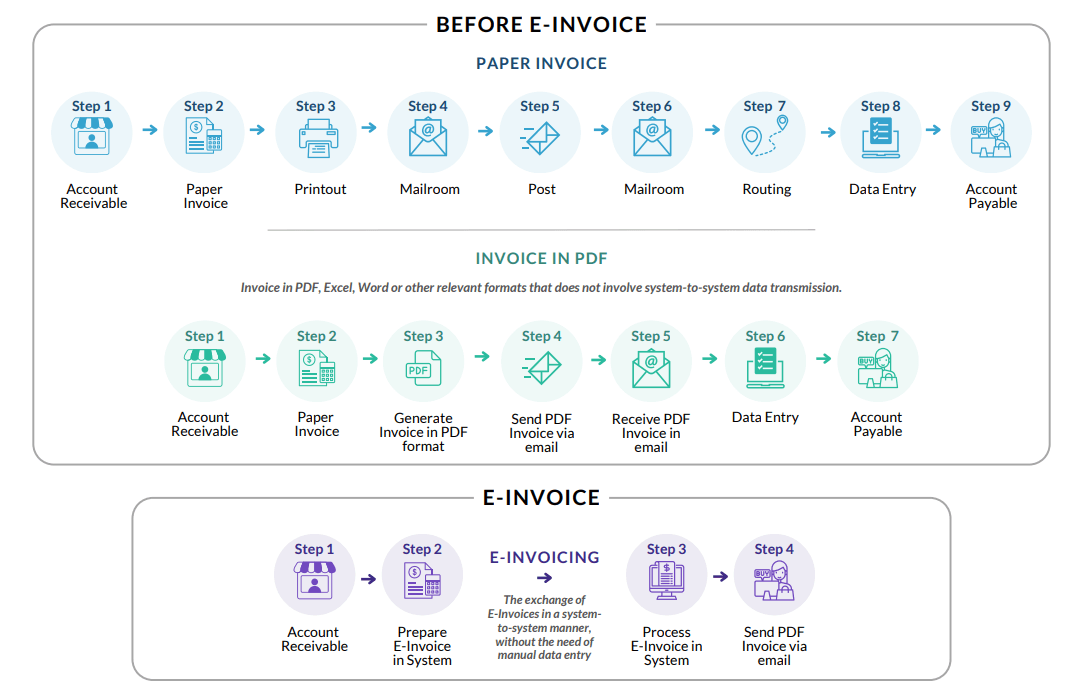

- Implementation of Global Minimum Tax (GMT)and Accelerated Capital Allowance (ACA) for e-invoicing

- Introduction of targeted incentives such as Investment Tax Allowance (ITA) for Smart Logistics Complexes (SLCs) and enhanced export incentives for Integrated Circuit (IC) Design Services

✓ Revenue and Fiscal Responsibility for Consumers and Businesses

- Broadening the Sales and Services Tax (SST) framework and rationalising subsidies

✓ Tax Measures and Reliefs for Individual Taxpayers

- Balancing the Introduction of new 2% Dividend Tax with extension of tax exemption on Foreign-Sourced Income (FSI)

- Introduction of targeted tax reliefs for certain individual taxpayers

✓ ESG-Driven Initiatives

- Introduction of a carbon tax and incentives for carbon capture, utilization and storage (CCUS) projects

As we navigate these changes line with the national aspiration, businesses and individuals must reassess their tax strategies to stay compliant and competitive.

Download our exclusive commentary now to navigate these changes with confidence. If you have any questions, please email our regional tax team at [email protected].

Related Business Insights

-

11 Oct 2024

How the Accounts Payable Process Works: A Comprehensive Guide

Learn how our outsourced services can streamline your accounts payable process to enhance efficiency, reduce costs, …

READ MORE -

26 Aug 2024

Mastering Payroll in Manufacturing Industry: Advanced Solutions for a Global Workforce

Simplify your payroll processing in manufacturing industry with BoardRoom’s real-time data processing and advance …

READ MORE -

08 Jul 2024

Guide to Filing Annual Returns in Malaysia

Ensure compliance and maintain your business's integrity in Malaysia with this guide on filing annual returns effic …

READ MORE