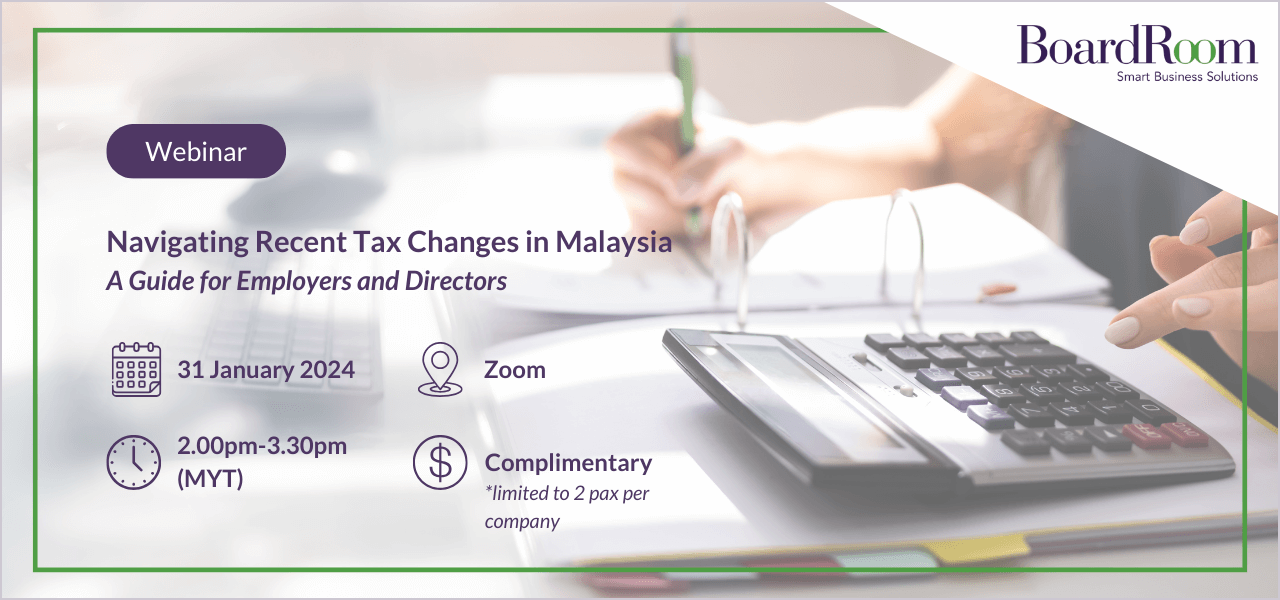

EVENT

Navigating Recent Tax Changes in Malaysia: A Guide for Employers and Directors

Company officers and directors must stay abreast of tax developments to safeguard the financial well-being of a company and discharge their fiduciary duties.

In this webinar, our tax experts discussed the following topics and shared their insights, helping employers make informed decisions during tax planning process.

- Employer’s statutory tax obligations

- Directors’ tax obligations and responsibilities

- Budget changes affecting employers

- E-services

- Childcare allowance exemption

- Hiring incentive for vulnerable groups

- Tax developments affecting companies

- Tax treatment for MSME

- Tax estimate (11th month)

- SST rate changes

- Sales tax on low-value goods

Contact our Tax Team today if require assistance in navigating these tax developments.

Speakers

Cheong Woon Chee, Head of Tax Services, BoardRoom Malaysia

Woon Chee is a chartered accountant and tax advisor with more than 15 years of experience in providing tax advisory services concerning corporate & individual tax, partnership & foundation tax compliance, tax incentives, tax audits & due diligence. Her broad clientele includes construction companies, property developers, hotels, logistics firms, plantations, education institutions, manufacturing and food & beverages companies.

Victor Cheow, Tax Manager, BoardRoom Malaysia

Victor has more than 10 years of tax experience, specializing in tax engagement and advisory for individual and corporate organisations, Sales and Service tax, tax audit and compliance and other tax related matters.