E-invoicing was announced in Malaysia as the Inland Revenue Board’s (IRB) solution to combating the issue of the shadow economy and revenue leakage. With the first major deadline in August 2024 fast looming, now is the time for businesses to start preparing for the transition.

E-invoicing implementation is significant for all businesses, and major changes may be required for systems, processes and even strategic direction. While the rollout will be phased, implementation is essential, with all businesses expected to comply by 1 July 2025.

What is e-invoicing and how can you maximise the benefits for your business? Our comprehensive guide offers you insight into the requirements, what you need to do to switch over and the benefits it can bring.

How does e-invoicing work?

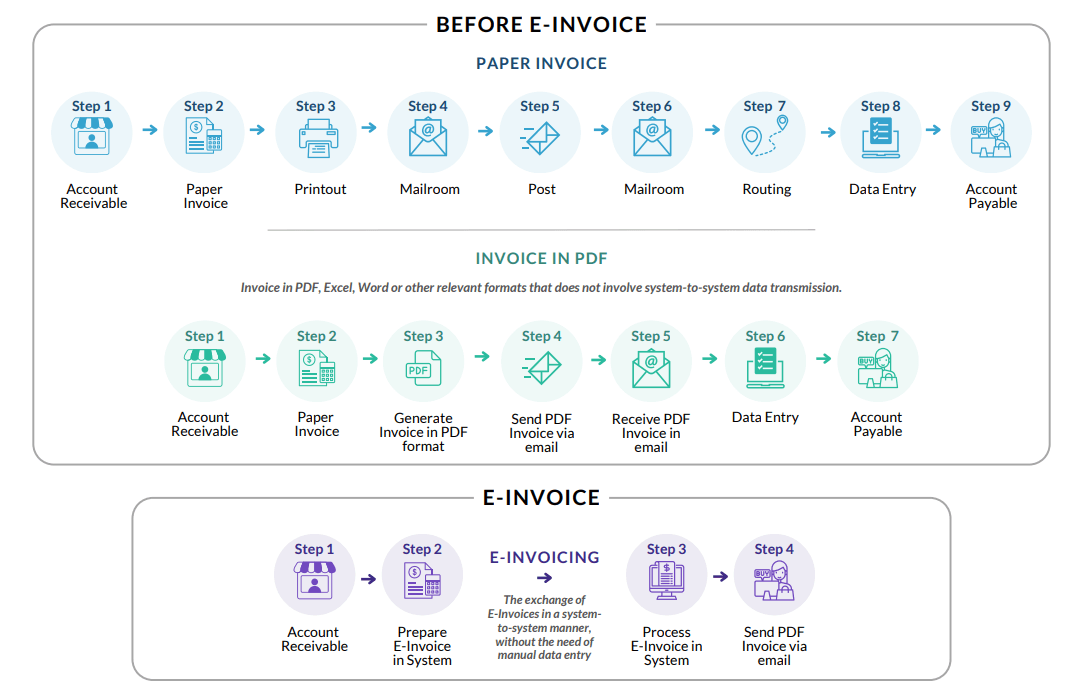

An e-invoice is a digital representation of a transaction between a supplier and a buyer. Many companies already issue electronic invoices, such as PDF invoices. However, having such electronic invoices does not necessarily mean being compliant with Malaysia’s e-invoicing requirements as set out by the Inland Revenue Board of Malaysia (IRBM). The Malaysia e-invoice requirements go beyond to include specific processes and reporting formats.

E-invoicing works by enabling seller’s accounts receivable to input invoices into their financial system, which then sends them in a structured electronic format directly to the buyer’s system. Upon receipt, the buyer’s e-invoicing system automatically processes and imports the data into their accounts payable system, which streamlines the payment process without the need for manual handling.

Only two formats of e-invoice are acceptable – XML and JSON. Both of these formats are easy for machines to read, which reduces the time it takes for a machine to translate and process the invoice.

What is the timeline for implementation?

There are a number of dates that you need to be aware of in the transition. It’s critical to be mindful of the timeline, as e-invoicing implementation can take up to three to four months to complete.

The following table provides a breakdown of the key dates for the e-invoicing implementation rollout based on business turnover.

| Annual Revenue of businesses | Implementation Date |

| Businesses with an annual turnover greater than RM 100 million | 1 August 2024 |

| Businesses with an annual turnover greater than RM 25 million and up to RM 100 million | 1 January 2025 |

| All businesses | 1 July 2025 |

The above timeline is subject to changes. Please refer to LDHN website for detailed guidelines and updates.

Exemptions from e-invoicing requirements

Certain types of income expenses do not require an e-invoice.

These include:

- Employment income

- Pensions

- Alimony

- Dividend distribution by companies listed in Bursa Malaysia, or companies that are not required to deduct tax under Section 108 of the Income Tax Act 1967

- Zakat

While government bodies, local authorities and statutory bodies are exempt from the e-invoicing requirements, they may voluntarily choose to participate. A complete list of exemptions is detailed in the IRBM’s official e-invoice guidelines.

A step-by-step guide to e-invoicing implementation

E-invoicing implementation is quite complex. The process may include upgrading infrastructure, integrating systems and training staff to ensure a smooth transition.

Here is a step-by-step guide to help you understand the process and how you can best implement e-invoicing.

1. Confirm business turnover

Your turnover will dictate when you must transition to e-invoicing. Refer to your 2022 audited financial statement or tax return to confirm your business turnover.

If you had a change of accounting year end for financial year 2022, your turnover or revenue will be pro-rated to 12 months. This will be used to determine your implementation date.

2. Conduct a gap assessment analysis

Cheong Woon Chee, Head of Tax Services, BoardRoom Malaysia, says that a gap assessment analysis is a critical next step in the process.

“A gap assessment will help you to determine what you need to do to meet the e-invoicing implementation requirements,” explains Woon Chee. “This should encompass current systems and processes but also the people and the training you’ll need to undertake in preparation for the transition.”

A comprehensive gap assessment should include the following components:

Once a gap assessment analysis has taken place, a tailored gap closure strategy should be developed that addresses the identified gaps. The strategy should provide detailed recommendations and action plans to ensure a seamless transition to e-invoicing. By understanding the requirements thoroughly, you can plan effectively, working backwards from the implementation date to ensure you are ready on time.

Having this lead time also gives you the opportunity to start talking to your clients, partners and service providers. They are critical in the transition, so it’s important to engage them early to understand their timelines and requirements.

3. Determine the best model for your needs

You have a choice between two e-invoicing models, which will depend on your business needs and size.

The first model uses the MyInvois portal, hosted by the IRB. This portal is available to all taxpayers, and Woon Chee says that if you’re processing around 20 invoices or less a month, MyInvois is a cost-effective solution.

“The other option is an application programming interface (API),” explains Woon Chee. “APIs are more suitable for businesses or taxpayers that process a substantial number of transactions.

“It is likely that your current systems will need enhancements or upgrades to support an API configuration, which comes with an upfront investment.”

4. Train staff on the new system

E-invoicing implementation involves training in the lead up to the transition as well as after the transition to ensure a seamless changeover.

“E-invoicing isn’t like the standard invoices staff are familiar with,” adds Woon Chee. “Initially, training should focus on awareness before moving to additional rounds of training that go into detail about the new process.”

Training is crucial and should cover the strategic approaches the organisation is taking to implement e-invoicing effectively across departments, the tax implications and the compliance requirements. Staff must understand the effects e-invoicing will have on existing accounting processes, especially as the new forms now feature over 50 mandatory fields, raising the chance of errors. Post-implementation training can help identify errors and ensure they are rectified moving forward.

5. Understand the PEPPOL network

The Malaysian e-invoicing requirement is powered by the Pan-European Public Procurement Online (PEPPOL) network. PEPPOL is not a provider. It is an enabler that allows any organisation to send and receive business documents – in this case, e-invoices – through PEPPOL-accredited service providers.

While businesses aren’t required to use a PEPPOL service provider for e-invoicing, there are benefits to doing so. Namely, a PEPPOL-enabled solution ensures effortless compliance and security, seamless integration and error-free automation with real-time insights into your e-invoice progress.

6. Apply for grants and tax incentives

There are grants and tax incentives available to support you with the costs of investing in the infrastructure required to transition to e-invoicing.

These include:

What are the benefits of e-invoicing?

According to the IRB, the benefits of e-invoicing include reducing manual work and associated human error. It will also help streamline operational efficiency, facilitate efficient tax filing, and digitise financial reporting to be in line with industry standards.

The Malaysia Digital Economy Corporate (MDEC) shares similar sentiments around the way e-invoicing will increase business efficiency, improve cash flow and facilitate effective tax reporting.

The BoardRoom team can see a range of benefits for our clients. Eunice Hooi, BoardRoom’s Managing Director Asia, Tax, explains that one of the biggest benefits is the minimisation of inaccuracies thanks to real-time monitoring.

“Shifting to e-invoicing will reduce inaccuracies, as both income and expenses are verified on the spot rather than retrospectively. This immediate validation allows businesses to promptly address any discrepancies identified by the tax authorities, such as disallowed expenses,” says Eunice.

The key benefits of implementing e-invoicing include:

- Seamless compliance through adherence to the e-invoicing mandates, PEPPOL standards and data security.

- Eliminate errors with automated creation, validation, delivery and archiving of invoices.

- Smooth integration with existing ERP and business applications, enhancing overall business operations.

- Gain real-time insights into the status of invoices to ensure timely payments, resulting in visibility and control.

- Save time and resources by digitising and automating invoicing processes, boosting cost savings and efficiency.

The switch to e-invoicing is not just a system change. It’s a complete mindset shift. A reliable partner will be a critical part of ensuring a seamless transition and maximising your investment.

“We are currently working very closely with some of the API and IT solution providers,” adds Eunice. “Aside from tax services and outsourced accounting services, we can provide our clients with an integrated service, including the IT component with a PEPPOL-Enabled Solution.”

BoardRoom offers a range of services to support you with your e-invoicing implementation. From standalone comprehensive project management service to training workshops or ad hoc consulting, we can tailor a solution to your needs. As your strategic partner, the BoardRoom team will help you to navigate the transition with ease.

“As outsourced accountants and tax experts, we can work with the finance team to advise them on strategically leveraging the e-invoicing data for tax optimisation,” explains Eunice. “For example, we can identify the deductible expenses immediately and ensure we maximise the tax credit and tax deduction without delay.”

Your partner in e-invoicing

With the right experts on your side, you will set your business up with a strategic advantage to leverage the benefits of the e-invoicing requirements. Learn more about BoardRoom’s e-invoice solutions to save you time and money for your e-invoicing transition and beyond. Our expert accounting and tax teams will ensure a smooth and compliant transition, providing you with support every step of the way.

Contact BoardRoom for more information:

Related Business Insights

-

28 Oct 2024

MY Budget 2025 : Key Tax Measures You Need to Know

Our exclusive Malaysia Budget 2025 Commentary delves into the intricacies of these tax measures, providing valuable …

READ MORE -

11 Oct 2024

How the Accounts Payable Process Works: A Comprehensive Guide

Learn how our outsourced services can streamline your accounts payable process to enhance efficiency, reduce costs, …

READ MORE -

26 Aug 2024

Mastering Payroll in Manufacturing Industry: Advanced Solutions for a Global Workforce

Simplify your payroll processing in manufacturing industry with BoardRoom’s real-time data processing and advance …

READ MORE