BoardRoom’s payroll administration services

Our highly-trained team can provide you with a host of payroll outsourcing solutions – whether you conduct business in Hong Kong only, or have offices in multiple countries across the Asia-Pacific region.

Hong Kong payroll outsourcing

Our BoardRoom team can help ensure your business complies with Hong Kong’s ever-changing payroll requirements. We handle all your payroll processing needs and provide advice, ideas and solutions if potential issues or risks are identified.

We can help with:

- Calculation and automated processing of gross to net pay, as well as Mandatory Provident Fund (MPF) or Occupational Retirement Schemes Ordinance (ORSO) contributions

- Preparation of payroll journals, payroll details and variance reports

- Paying net salary, MPF contributions and ORSO contributions via bank accounts

- Delivering private pay slips (digital or paper)

- Production of year-end reporting forms and appendices (digital or paper)

- Calculating statutory entitlement amounts under the Employment (Amendment) Ordinance

- Organising and lodging employer tax return forms

Payroll services – Hong Kong

BoardRoom provides payroll outsourcing services in 19 countries and regions, including:

Hong Kong

Hong Kong Australia

Australia China

China India

India Indonesia

Indonesia

Japan

Japan Macau

Macau Malaysia

Malaysia Myanmar

Myanmar

New Zealand

New Zealand Philippines

Philippines Singapore

Singapore South Korea

South Korea

Thailand

Thailand Taiwan

Taiwan UAE

UAE Vietnam

Vietnam

We also provide flexible payroll services, giving you the ability to either:

- base coordination at BoardRoom Hong Kong; or

- decentralise coordination through our network of local offices.

We can help with:

- preparing and submitting local statutory documents and filings;

- administration of international pay runs;

- ensuring complementary payroll and tax management;

- digital processing of leave application forms and expense claims; and

- true multi-country payroll processing.

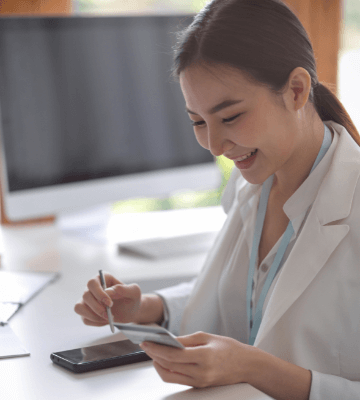

Modernise your payroll system

BoardRoom’s all-in-one human resources management system (HRMS), Ignite, is the key to our success as a top-tier payroll services provider. The cloud-based HR payroll software is designed to keep up with technological advances and helps streamline your payroll processes. By removing the need for multiple payroll platforms, Ignite makes international payroll processing intuitive and straightforward.

With unrivalled reporting features, Ignite provides you with valuable insights into your workforce data so you can make data-driven decisions.

Ignite provides:

- 5 core modules: Payroll, Personnel, Leave, Attendance and Claim

- true multi-country payroll experience with multi-lingual support and a single login for international processing of pay, claims and leave

- complete compliance with local laws in nine countries and regions across Asia

- an easy-to-use mobile app for 24/7 access to pay slips, claims and leave application forms

- a rostering system, a shift calendar and attendance-recording functions

- a dedicated account manager for one simple point of contact

With Ignite, you can improve the efficiency of your regional payroll management while granting your staff more control and visibility for business planning purposes.

Frequently Asked Questions (FAQs)

1. What is included in the scope of payroll services?

Payroll services include the calculation and automated processing of the gross net salary, MPF or ORSO contributions, statutory entitlement pays, disbursement of salaries, managing of payroll records, leave applications, expense claims, tax return forms, and more for each employee.

2. How much do payroll services cost?

Pricing for Payroll services in Hong Kong can range between HK$60 to HK$120 per employee, per month. The total cost will of course vary, based on how many employees you have as well as how comprehensive the service is. Other additional costs of services may include a one-time implementation fees for the payroll platform setup, data migration of employees if you are switching to a new platform, or integration costs with other HR processes if you are building a fully-fledged HR platform. Engaging a professional payroll service provider like BoardRoom will guarantee you a seamless integration.

3. What are payroll outsourcing services?

Payroll outsourcing services generally mean the outsourcing of your company’s core payroll operational functions such as payroll calculation, salary disbursements, leave, claims, and time and attendance to a third-party payroll service provider. A professional outsourced payroll company can help ensure that your workforce’s salary and financial HR matters are executed in a more accurate, seamless, and efficient way. Outsourcing payroll helps free up your internal HR team and resources from labour-intensive and mundane work to focus on more important aspects of HR activities such as talent sourcing or employee engagement.

4. How does outsourcing payroll work?

Outsourcing payroll starts from hiring a third-party company to organise and manage your payroll services. This can be particularly useful for small and large companies that are growing at a rate their internal teams cannot keep up with. Companies like BoardRoom have a team of professionals that can craft personalised payroll management plans for your business, meaning your payroll tasks will be taken care of in a timely and professional manner. This way, you can have peace of mind knowing that your business is fully compliant with all the necessary local employment regulations, and that each of your employees have their payroll matters under control.

There are several different types of payroll services for your business to choose from. A full outsourcing solution will include everything from calculating disbursements to pay runs and reporting. Alternatively, basic options entail monthly pay runs with data supplied by the business.

5. Why and when should you outsource your payroll?

Outsourcing your payroll can be an effective solution for companies of all sizes, from startups to MNCs. Smaller businesses who might be unable to hire a dedicated in-house payroll professional will benefit from expert services from payroll service provider. Larger companies on the other hand, can reduce costs and streamline operations with a single point of contact, thus gaining efficiency. For all companies, outsourcing relieves the headache of payroll work and allows you to focus on core business competencies rather than internal administrative work.

Your company will be able to reap the benefits of outsourcing payroll work at any time. Many businesses choose to outsource at a time when they are experiencing or predicting a period of growth. Having an influx of new employees can make payroll services hard to keep up with, and finding the necessary personnel to do so can be difficult. A full-suite corporate services provider like BoardRoom can easily accommodate for periods of intense growth, keeping your payroll tasks processes compliant and your employees happy.

6. What are the advantages of outsourcing payroll?

Outsourcing payroll offers your company the chance to streamline, optimise, and improve administrative operations. By handing off your payroll duties to a third-party company, you are guaranteed a professional standard of service. Furthermore, companies who are growing rapidly will find that outsourcing payroll and other corporate services will allow you to adapt more quickly and stay organised. You’ll also free up a considerable amount of time and resources to scale and innovate your business instead.

7. How secure is outsourcing payroll?

Outsourcing your payroll can be very secure, as long as you pick a reputable company to work with. When evaluating and weighing up different vendors, consider what certification and attestation they may have. A reputable company will possess ISO 9001, IOS 27001, and SOC2 certificates, as well as attestations such as the International Standard on Assurance Engagements (ISAE 3402).

8. How to choose the right payroll and HR service provider for your business?

When choosing the right payroll and HR service provider for your business, there are several points you should be asking:

- How much experience do they have?

- How much do they charge for their services?

- Do they have good customer support?

- How well do they keep up with regulatory changes?

- What kind of technology do they use?

A competent and experienced payroll service provider should be able to meet all these requirements with ease and provide actual case studies of successful implementations.

9. How can a payroll processing company help my business?

A payroll processing company will help you calculate the gross net salary as well as MPF or ORSO contributions before disbursing them to your employees. Depending on the company, they may offer additional services like handling of leave and claims, and filing of employee income tax returns.

10. How can BoardRoom help in payroll services?

At BoardRoom, we have our own advanced payroll platform, Ignite, and a team of specialists ready to help take your business to the next level. We have plenty of regional experience and can handle a wide range of payroll and human resources services for Hong Kong businesses looking to grow. Find out more information regarding our payroll software platform, or get in touch with us today.